Chapter 2: CapitalSurn – Formula and Levy Mechanisms

Introduction: A Tax Serving Innovation

CapitalSurn is deposited directly into an investment account in the name of the executive at the SurnBank, which mobilizes additional investment funds (FondSurn) for the benefit of the CadreSurn or a group of CadresSurn for productive placement. FondSurn or CapitalSurn are never paid to individuals.

CapitalSurn is reversible to the SurnBank for the benefit of future generations. A CapitalSurn in default is automatically transferred to an active FondSurn. Any beneficiary of an InvestissementSurn is excluded from private or state retirement schemes.

CapitalSurn is the operational pillar of Surnumerism, transforming human productivity into a lever of equity. This progressive tax on large corporations (revenues >1 billion USD or >500 employees) redistributes surplus wealth via the SurnBank, supporting the work of senior executives in productive projects. Unlike traditional taxes, it does not penalize but catalyzes entrepreneurial continuity, relying on trust in financial flows for smooth redistribution.

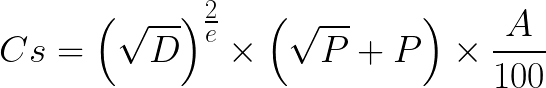

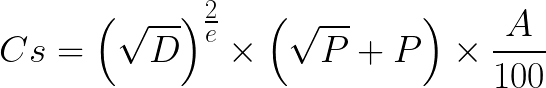

The CapitalSurn Formula

The formula, rigorously calibrated, is:

- D: Level of diploma (1–5, e.g., 2 for master’s).

- E: Years of experience (weighted by 0.5 to limit age effect).

- R: Contribution to revenues (in %, max. 50).

- Effective rate: 2.37% to 4.66%.

Example: An executive with a doctorate (D=3), 15 years of experience (E=15), and 30% contribution (R=30) in a company with 1 billion USD revenue generates:

[ \text{CapitalSurn} = \left( \frac{3 + (15 \times 0.5) + (30 \times 0.1)}{100} \right) \times 1\,000\,000\,000 = 135\,000\,000\,USD ]

- ( P ): Base capital.

- ( \sqrt{P} + P ): Root premium plus capital.

- ( \left( \sqrt{D} \right)^{\frac{2}{e}} ): Exponential growth factor (equivalent to ( D^{1/e} )).

- ( \frac{A}{100} ): Percentage adjustment.

Surnumerism ensures a smooth and continuous transfer of prosperity vectors.

The SurnBank: Management and Redistribution

Funds are deposited into the SurnBank, a hybrid institution (30% corporations, 25% government, 30% banks, 15% NGOs + private). Contributions from corporations and government are non-refundable. FondSurn represents 15% of contributions.

The SurnBank allocates:

- 70%: Entrepreneurial projects (e.g., green startups).

- 20%: Continuing education.

- 10%: Fundamental research.

```mermaid graph TD A[Large Corporations] -->|Levy| B[SurnBank] B -->|70%| C[Executive Startups] B -->|20%| D[Training] B -->|10%| E[Research] : Pour le Brésil, production viande 2024 : 10M tonnes (USDA) vs export 2M tonnes ; diagrammes : ligne croissante pour revenus vs barres pour CapitalSurn alloué -->

La SurnBank : Gestion et Redistribution

Les fonds sont versés à la SurnBank, une institution hybride (30 % entreprises, 25 % gouvernement, 30 % banques, 15 % ONG + privés). Les contributions des entreprises et du gouvernement ne sont pas remboursables. Les FondSurn représentent 15 % des contributions.

La SurnBank alloue :

- 70 % : Projets entrepreneuriaux (ex. : startups vertes).

- 20 % : Formation continue.

- 10 % : Recherche fondamentale.

```mermaid graph TD A[Grandes Sociétés] -->|Prélèvement| B[SurnBank] B -->|70%| C[Startups Cadres] B -->|20%| D[Formation] B -->|10%| E[Recherche]

Une IA open-source audite les projets, et un NDA éthique protège l’IP.

Compensations et Apports Externes

Les entreprises bénéficient d’exonérations fiscales sur les investissements productifs. Les fonds sont amplifiés par :

- Prêts bancaires (5 % des portefeuilles).

- Subventions ONU (PNUD, OIT).

- Ponctions sur cryptos (0,1 % par transaction).

Conclusion

Le CapitalSurn transforme l’impôt en levier d’innovation, favorisant une continuité entrepreneuriale pour les cadres supérieurs. Le chapitre suivant explore la moralisation de la finance.